Email marketing in financial services isn’t simple.

You’re not selling hoodies, SaaS trials, or weekend travel deals. You’re communicating with audiences who are cautious, regulated, skeptical, detail-driven, and extremely sensitive to trust signals.

In this environment, the email marketing tool you choose matters just as much as the message you send.

And this is precisely where HubSpot stands out because it gives financial service businesses a complete ecosystem for compliant, personalized, high-performing email communication across the entire customer lifecycle.

If you’ve ever felt the pressure of juggling compliance, segmentation, lead nurturing, reporting, and revenue attribution… this blog will make you exhale.

Let’s break down how HubSpot becomes a top-tier email marketing solution built for the realities of modern financial service organizations.

Why Email Marketing Feels Harder in Financial Services

Before we talk about HubSpot, we need to address the core truth:

Financial service businesses operate under constraints most industries never face.

Your email system needs to manage:

- Stricter compliance rules (FINRA, SEC, GDPR, local banking regulations)

- High-risk content categories

- Longer conversion cycles

- Multiple decision-makers

- Data privacy and security expectations

- Complex customer journeys involving advisors, agents, underwriters, brokers, and support teams

- Reputation-sensitive communication, where one mistake can harm the brand

Most email platforms weren’t built to handle this level of nuance; they were built for marketers who want to send promotions quickly.

But HubSpot was built differently. It approaches email as an integrated discipline: CRM + automation + reporting + personalization + compliance + marketing intelligence.

That’s why financial firms, wealth advisors, insurance companies, lending firms, fintech companies, and B2B financial service providers consistently choose it.

Now let’s break down the exact reasons why.

Why HubSpot for Email Marketing?

Here are the 11 top reasons financial businesses choose HubSpot for secure, structured, and strategic email marketing:

1. No More Scattered Financial Data

Financial services depend on accurate and up-to-date data. If your email platform isn’t synced to reliable, real-time customer data, every campaign runs the risk of being irrelevant, mistimed, and non-compliant.

HubSpot solves this problem by keeping Email + CRM in one place. Every email you send is powered by live CRM data and not siloed information present on spreadsheets.

Financial service teams especially love this because it supports:

- Advisor-specific communication

- Lead-to-client transition visibility

- Due diligence tracking

- Relationship history across teams

Through this, HubSpot becomes a complete financial relationship ecosystem for them instead of just an email sender.

2. Relevant Email = Higher Trust

Financial decisions are personal, and sending generic emails erodes trust. HubSpot gives you segmentation options for sending personalized emails. You can segment the audience based on:

- Risk tolerance

- Financial product interest (loans, investment types, insurance lines, etc.)

- Lifecycle stage

- AUM (assets under management) ranges

- Product maturity

- Transaction behavior

- Engagement score

- Trigger events (webpage visits, form submissions, advisor conversations)

For Example:

A wealth management firm can create separate nurtures for:

- Prospects exploring retirement planning

- High-net-worth investors interested in tax-efficient portfolios

- Smaller accounts needing educational financial literacy content

The result? Higher open rates, more advisory appointments, and stronger retention.

3. Email Workflows that are Compliance-Ready

Financial service businesses have strict compliance responsibilities, and HubSpot makes it easier, not harder.

Here’s how:

- HubSpot automatically manages Subscription types, Opt-in consent, Proof of permissions, and Unsubscribe rules to meet GDPR, CAN-SPAM, and region-specific requirements.

- It allows Multi-level approval workflows, Role-based access, commenting and collaboration, Protected email templates, and Locked modules for compliance-restricted content.

- Many financial firms require email retention for 5+ years, so HubSpot integrates with archiving systems to ensure no data is changed and emails remain export-ready whenever needed.

- Additionally, with score-based risk flags, Teams can tag emails under sensitive messaging, high-risk investor groups, and restricted product-related content.

4. Hyper-Personalized Email Crafting

HubSpot automates personalization so every message feels relevant without extra manual effort.

- Smart Content: Emails change based on user behavior and financial interests.

- Personalization Tokens: Insert advisor name, product type, or renewal info to make emails feel tailored.

- Trigger-Based Emails: Automatically send when users take key actions like viewing calculators, downloading guides, or approaching renewal dates.

Simple, accurate, and built for financial customer journeys.

5. Automation for the Financial Customer Journey

HubSpot automates complex nurture paths so no lead or client touchpoint is missed.

- Lead Nurtures: Automated education sequences for prospects.

- Advisor Handoffs: Smooth transitions when a lead becomes sales-ready.

- Renewals & Reminders: Automatic alerts for insurance, loans, or portfolio updates.

- Cross-Sell/ Upsell: Personalized offers based on financial stage or behavior.

Everything runs in the background while your team focuses on clients.

6. Ready-to-Use Email Templates

HubSpot provides structured templates to keep financial communication clean and compliant.

- Drag-and-drop layouts

- Locked compliance sections

- Mobile-responsive designs

Teams stay consistent without rewriting from scratch.

7. Reporting To Shows the Actual Revenue

One of the biggest challenges in financial marketing is proving the ROI of your emails.

HubSpot changes the game with reporting that shows:

- Which email nurtures produce qualified leads

- Which campaigns lead to booked consultations

- Which sequences create the highest revenue

- Where prospects drop off in the financial journey

- Which advisors or teams generate the strongest response

HubSpot’s Revenue Attribution Reporting Instantly Answers:

- “Which email generated the most deals?”

- “Which campaigns bring high-value clientele?”

- “How many touchpoints did it take to convert a client?”

You no longer fight to justify your work; instead, you simply show the data.

8. The Real Game-Changer: AI-Powered Email Optimization

HubSpot’s AI tools help financial marketers optimize without risking compliance.

Key AI features:

- AI subject line suggestions

- Send-time optimization

- Automatic A/B testing insights

- AI-driven segmentation

- Predictive lead scoring

These tools increase performance while keeping the message aligned with approved content standards.

9. Tools To Strengthen Every Email You Send

Financial marketing succeeds when trust grows.

HubSpot supports trust-building with:

Contact-level engagement history

Advisors can see:

- Every email opened

- Every PDF downloaded

- Every link clicked

- Every interaction across departments

Content personalization tokens

Your emails feel intentional and not automated.

Progressive profiling forms

You gather only the correct information at the right time.

Connected channels

Emails seamlessly integrate with:

- Forms

- SMS

- Chat

- Landing pages

- Customer portals

- Service tickets

Clients experience one unified brand.

10. High Deliverability for Regulated Industries

Financial emails must land in the inbox; otherwise, compliance and communication both fail.

HubSpot maintains:

- Strong domain authentication (SPF, DKIM, DMARC)

- Verified IP warmups

- Bounce management

- Reputation monitoring

Financial service businesses consistently experience higher email deliverability on HubSpot than on traditional email tools.

11. Built for Distributed Teams Like Advisors & Agents

HubSpot isn’t just for corporate marketing teams. It's built to support distributed financial operations like individual email signatures, team-based permissions, localized outreach, advisor-level analytics, shared templates, access controls, etc.

This means your:

- Insurance agents

- Wealth advisors

- Loan officers

- Customer service reps

- Partnerships teams

…can all communicate consistently without risking message deviation.

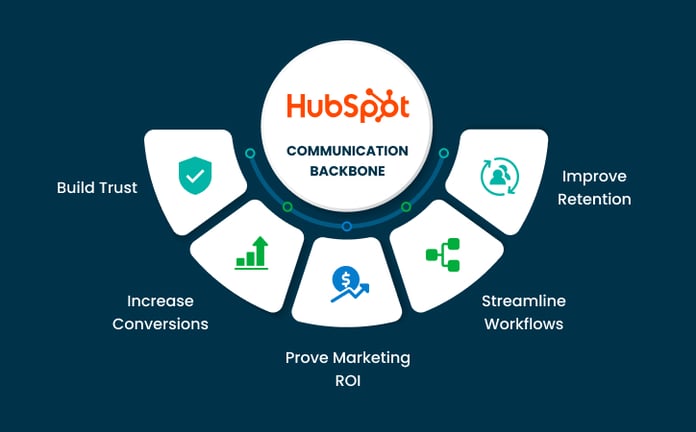

So What Does This Mean for Financial Service Businesses?

HubSpot becomes more than an email marketing tool. It becomes the communication backbone that helps financial companies to increase conversions, build trust, improve retention, streamline workflows, and prove marketing ROI anytime and anywhere.

And most importantly, it helps financial brands communicate with clarity, confidence, and credibility, at scale.

Who Should Consider HubSpot for Email Marketing in Financial Services?

HubSpot is a right fit for your finance business if you are a:

- Wealth management firm

- Insurance agencies

- Mortgage & lending companies

- Fintech platforms

- Accounting & advisory firms

- B2B finance providers

- Private equity & venture teams

- Commercial lending & real estate financing

In short, if you need personalization, automation, compliance, and credibility in every email… HubSpot is exactly the tool you’ll need to power your ecosystem.

How Buldok Marketing Helps You Set Up High-Performing Email Marketing on HubSpot

At Buldok Marketing, we specialize in helping financial service businesses turn HubSpot into a fully optimized email marketing engine for their revenue growth. Here’s how we can help you:

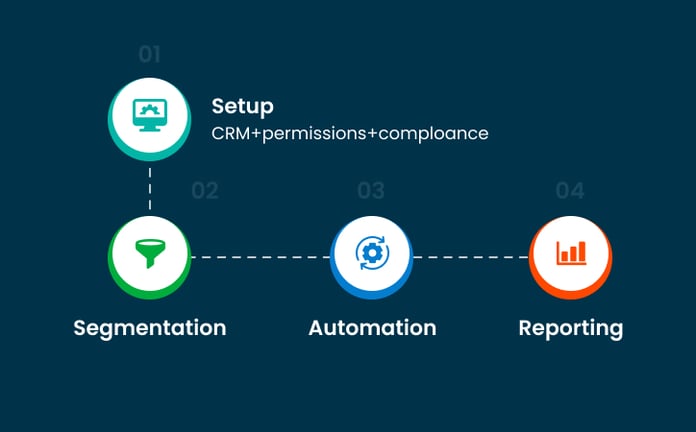

HubSpot Setup

We configure your account end-to-end, including HubSpot onboarding, contact properties, subscription types, email settings, compliance preferences, and integrations. So everything works smoothly from day one.

Segmentation Built for Financial Journeys

We create smart, compliant segments based on product interest, financial goals, lifecycle stages, advisor ownership, engagement signals, and more. You get precise targeting without manual effort.

Automated Nurture Sequences That Build Trust

We design the entire email ecosystem:

- Lead-to-client nurture flows

- Renewal and maturity reminders

- Cross-sell and upsell sequences

- Advisor handoff automation

- Re-engagement campaigns

These help you communicate consistently and convert more high-quality clients.

Compliant Email Templates for Financial Communication

We build branded templates that include your disclosures, disclaimers, and compliance-safe structures. So every advisor and marketing team member stays aligned.

Performance Reporting That Shows Real ROI

We set up dashboards that track open rates, conversion paths, influenced revenue, and advisor-level performance, giving your leadership team complete clarity.

Ongoing Optimization & Support

Email marketing isn’t “set it and forget it.” We continually refine workflows, segmentation, deliverability, and content to keep performance strong month after month.

Final Verdict

If you want HubSpot to do more than just send emails, Buldok Marketing is ready to help. We set up everything from segmentation to automation to reporting, so your team gets a fully optimized email system built for trust, clarity, and growth.

Ready to turn HubSpot into your most substantial email marketing advantage? Let’s build it together.